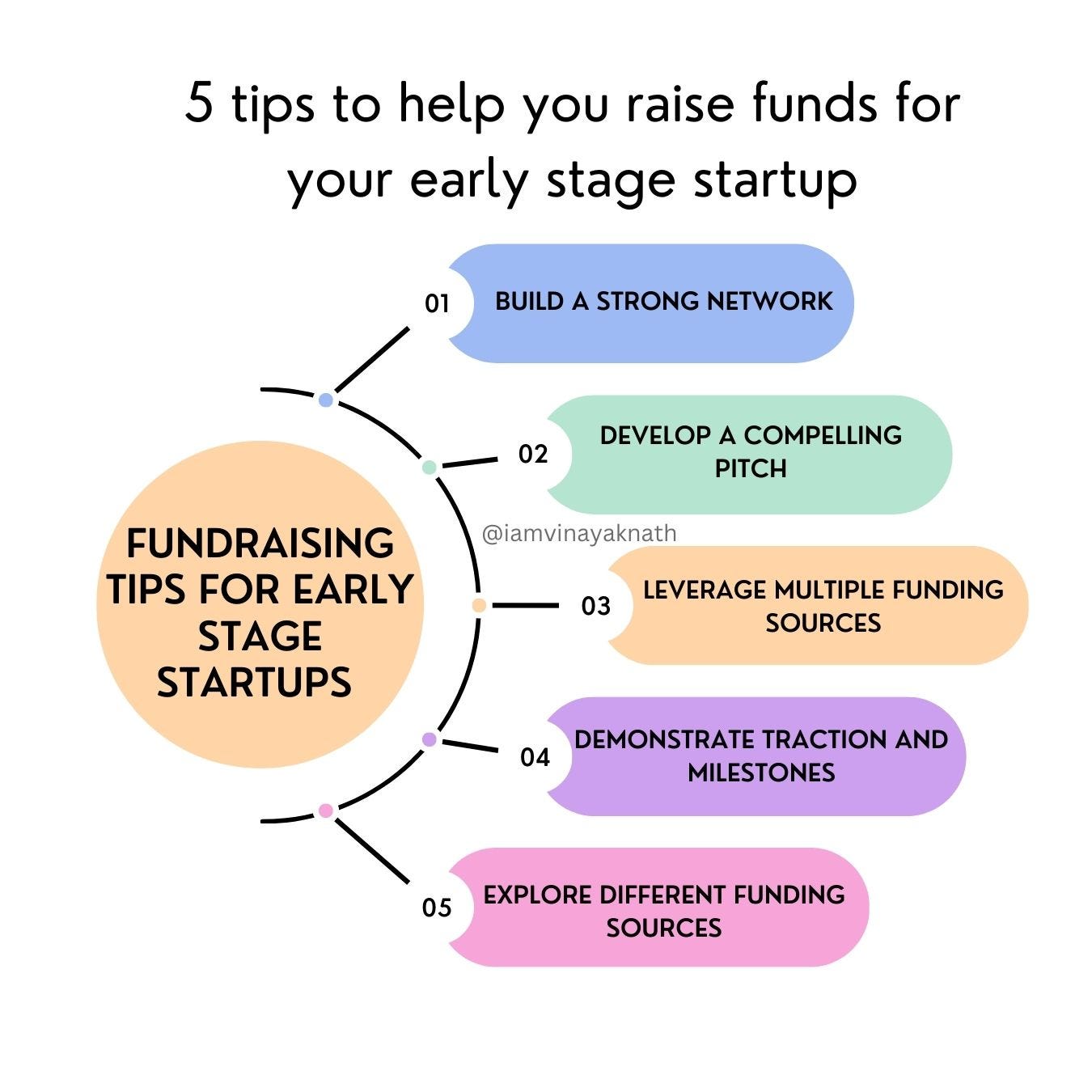

As someone deeply immersed in the startup world, I understand the ebbs and flows that entrepreneurs face when building their dreams from the ground up. Securing funding is one of the most daunting challenges, yet it’s a crucial step towards transforming an idea into a thriving business. In this detailed guide, I’ll walk you through How To Raise Funds For Your Startup employing five essential strategies that uncover the art of attracting the capital needed to fuel your startup’s journey.

Direct Answer:

To raise funds for your startup, evaluate your financial needs, consider different funding stages, craft a strategic business plan, network to build relationships, leverage online platforms, understand legalities, maintain transparent financial records, master your pitch, negotiate effectively, and utilize funds with precision.

Understanding the Need for Funding

Assessing Financial Requirements

Before embarking on the fundraising journey, it’s imperative to carefully assess the financial requirements of your startup. This process enables you to:

- Align your startup’s growth ambitions with the actual capital needed.

- Break down the costs in terms of operations, development, marketing, and expansion.

- Analyze the potential return on investment for each business operation.

Differentiating Funding Types and Stages

Understanding that funding is not one-size-fits-all is essential. Your startup might benefit more from an angel investor’s support in its early stages, while a venture capital injection could be more suitable during scale-up phases. Recognizing the nuances of seed funding versus Series A, B, C, and so on, helps in targeting the right investors at the right time.

Source: Medium

Crafting Your Funding Strategy

Know Your Options: Types of Funding

There are a plethora of avenues to explore when it comes to funding your startup. Let’s break down a few options:

- Bootstrapping: Self-funding that maintains complete control but might limit growth speed.

- Loans: Traditional bank loans or SBA loans, which must be repaid with interest.

- Investors: This includes angel investors and venture capitalists who take equity stakes.

- Crowdfunding: Sites like GoFundMe offer a way to raise money and validate your business concept through the power of the crowd.

Each funding source comes with its own set of advantages and drawbacks – assessing them against your startup’s objectives and vision is critical. When considering equity funding versus debt financing, think about long-term control and stakeholder management.

Preparing a Solid Business Plan

A compelling business plan does more than just outline your vision; it also serves as a vital tool to attract investors. A stellar plan should include:

- In-depth market analysis demonstrating demand for your product or service.

- Financial projections that paint a picture of potential growth and scalability.

- A unique value proposition that sets you apart from the competition.

As you structure your business plan, remember to review materials like those on the Small Business Administration website, where it’s stated that well-prepared materials are key to comparing and securing the best loan offers.

Approaching Potential Funding Sources

Networking and Building Relationships

Fostering connections within the startup ecosystem is an investment in your startup’s future. Engage with:

- Events: Attend industry meetups and pitch events to get your idea in front of investors.

- Startup hubs: Become part of incubators or accelerators where mentorship and funding opportunities are ripe.

- Engagements with venture capitalists and angel investors should be approached with a mindset of building trust and demonstrating long-term viability.

Leveraging Online Platforms

In our digital age, tapping into online platforms for funding can be particularly effective. Crowdfunding campaigns not only raise capital but also serve to validate your business idea before a global audience. As Mentorcam points out, incentives such as product pre-orders or exclusive experiences can entice backers to contribute.

Navigating the Legal and Financial Aspects

Understanding the Legal Implications

Diving into the realms of investment necessitates a clear understanding of legalities related to raising capital. Important aspects include:

- Investment terms and conditions.

- Ownership structures and potential dilution of equity.

- Compliance with government regulations and investment laws.

Keeping Financial Records and Projections Transparent

Transparency is crucial when dealing with potential investors. Clear, accurate financial statements and risk disclosures help build credibility. Use projections to illustrate your startup’s stewardship and expected growth trajectory.